H2 2020

Shareholder Letter

*Historical figures have been adjusted since prior publications of results.

Business resilience amid global pandemic

Substantial net revenue growth (70%) in North America

Strong growth in online retail due to accelerated digitization of global commerce

Surging ecommerce volumes alongside store reopenings

Strong performance across growth pillars

Well-diversified merchant base compensated for declining travel volumes in enterprise

Momentum in unified commerce due to acceleration of longer-term tailwinds

Growing the mid-market merchant portfolio

Merchant-driven innovation on the single platform

Building IdentityRisk — sub-seller fraud checks on Adyen for Platforms

Scaling Adyen Issuing — rolling out over 30,000 cards with a single merchant

Launched mobile Android POS devices

Scaling the Adyen team and culture

Growing the team to 1,747FTE — focus is on scaling the culture

The team’s wellbeing as a focal point during COVID-19

Global expansion - opening an office in the Middle East

Enterprise

The enterprise space continued to drive the majority of our growth. Our continued success in this space stems from our ability to solve for our merchants’ payment complexities and how we build trusted partnerships with them. We consistently grow with them as they expand to new regions, sales channels, and product lines.

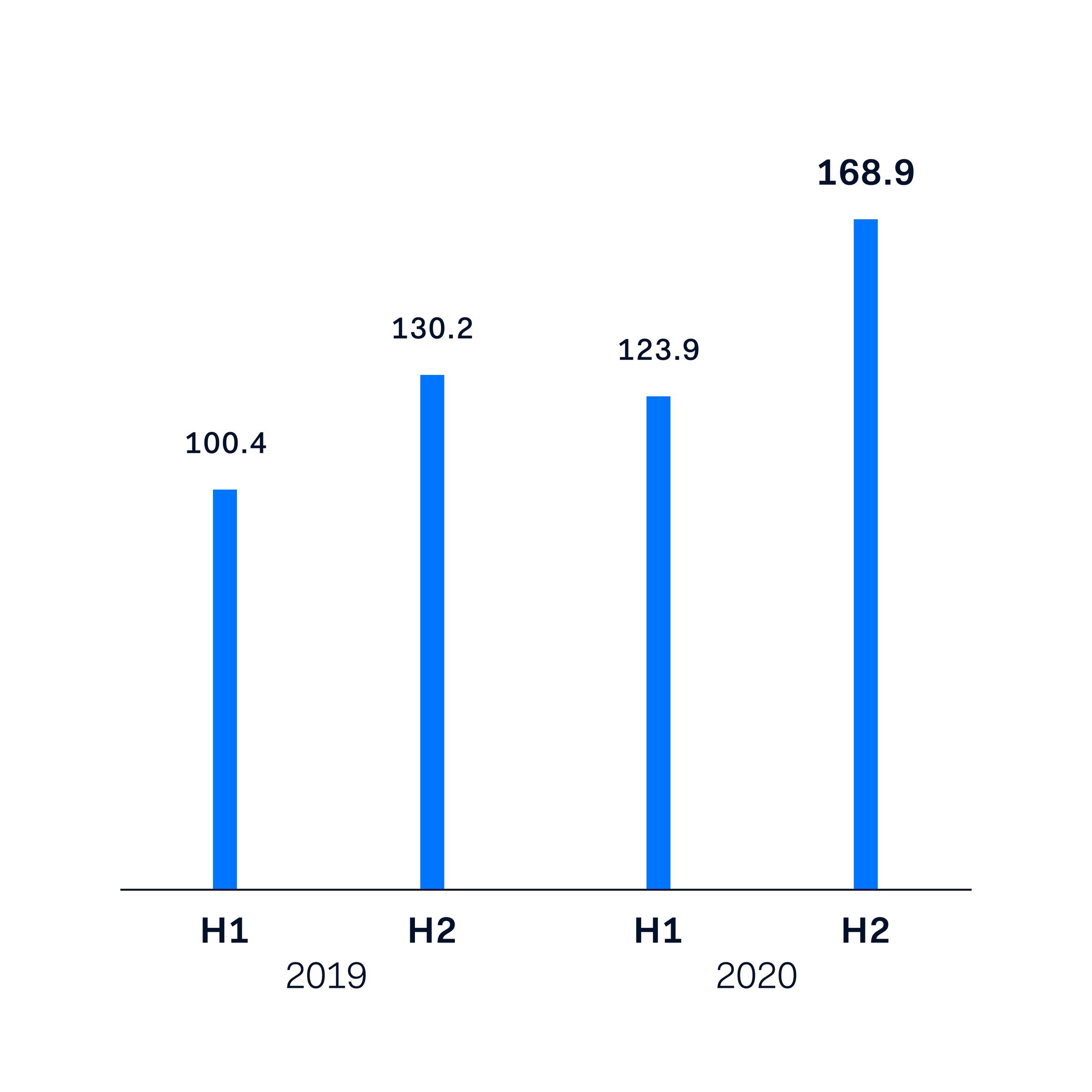

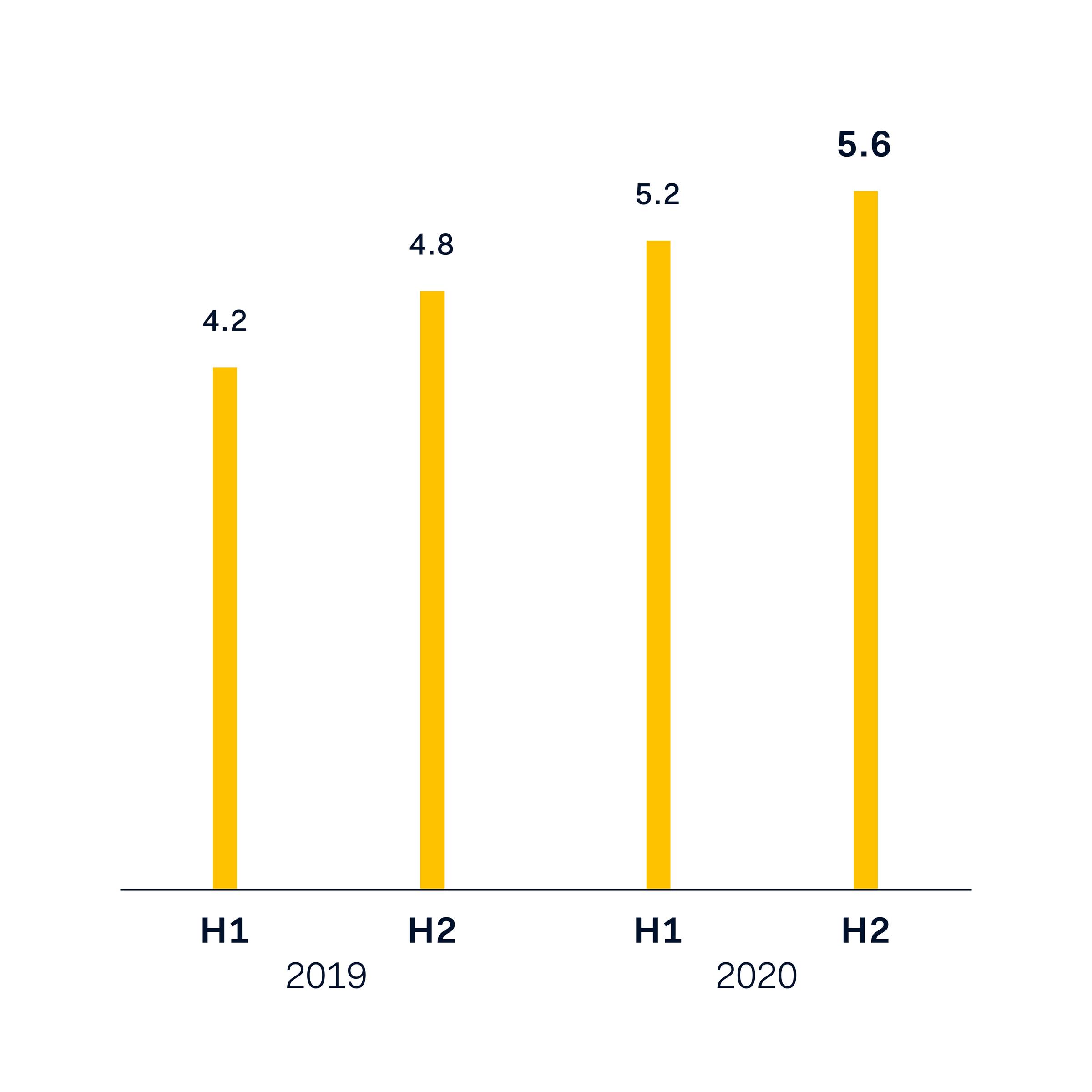

Enterprise volume in EUR billions

Unified Commmerce

The pandemic further accelerated the trend of merchants opting for a unified commerce approach. We saw that unified commerce merchants were more resilient when dealing with the challenges of the pandemic due to the flexibility of quickly shifting volumes between sales channels.

POS volume evolution, including share of total processed volume in EUR billions

Mid-market

We remain focused on building out our mid-market offering, and supporting these merchants in growing their business while solving for their payment complexities that arise along the way. In line with previous periods, we saw numerous mid-market merchants organically graduate into the enterprise segment.

Mid-market volume in EUR billions. We define mid-market merchants as merchants processing up to €25 million annually on our platform. In H2 2020, 4,278 merchants met this definition.

Interim Condensed Consolidated Financial Statements H2 2020 Adyen N.V.

Unsponsored ADRs: As of October 10, 2008, the US Securities and Exchange Commission (SEC) published revisions to Exchange Act Rule 12g3-2(b) which permits depository institutions to establish unsponsored ADR programs without the participation of a non-US issuer. Adyen NV does not consent to the establishment of any unsponsored ADR program, and further does not authorize, endorse, support or encourage the creation of any such unsponsored ADR program in respect of its securities. Adyen NV will not actively, directly or indirectly participate in the creation of any unsponsored ADR program. Adyen NV specifically disclaims any liability whatsoever arising out of or in connection with any unsponsored ADR program. Adyen NV does not represent to any depository institution or any other person, nor should any depository institution or any person rely on a belief that the website of Adyen NV includes all published information in English or that Adyen NV otherwise satisfies the exemption criteria set forth in Exchange Act Rule 12g3-2(b)