H1 2020

Shareholder letter

Continued profitable growth during the COVID-19 pandemic

Business resilience due to diversification across verticals, merchant base and geographies

Online retail and digital goods volumes accelerated while travel and in-store volumes slowed down following lockdown restrictions

EBITDA margin at 50% as we continue to invest in headcount

Building for the long term – people and tech

Scaling the team to capitalize on long-term growth opportunities

Investing in the platform with 43% of new hires in tech

Maintaining the Adyen culture, for now from a distance

Volume contributions across growth pillars

Onboarding volume at scale in the enterprise space

Continued increase of merchants opting for unified commerce approach

Investments in long-term approach to mid-market

Incremental innovation led by merchants’ needs

Ongoing build-out of product suite to address merchants’ needs

Expanding the global footprint of the single platform

New product features to solve for complexity across the industry

Enterprise

In line with previous periods, existing enterprise merchants contributed to the majority of our growth. We continued to win additional geographies, sales channels and product lines with existing enterprise merchants.

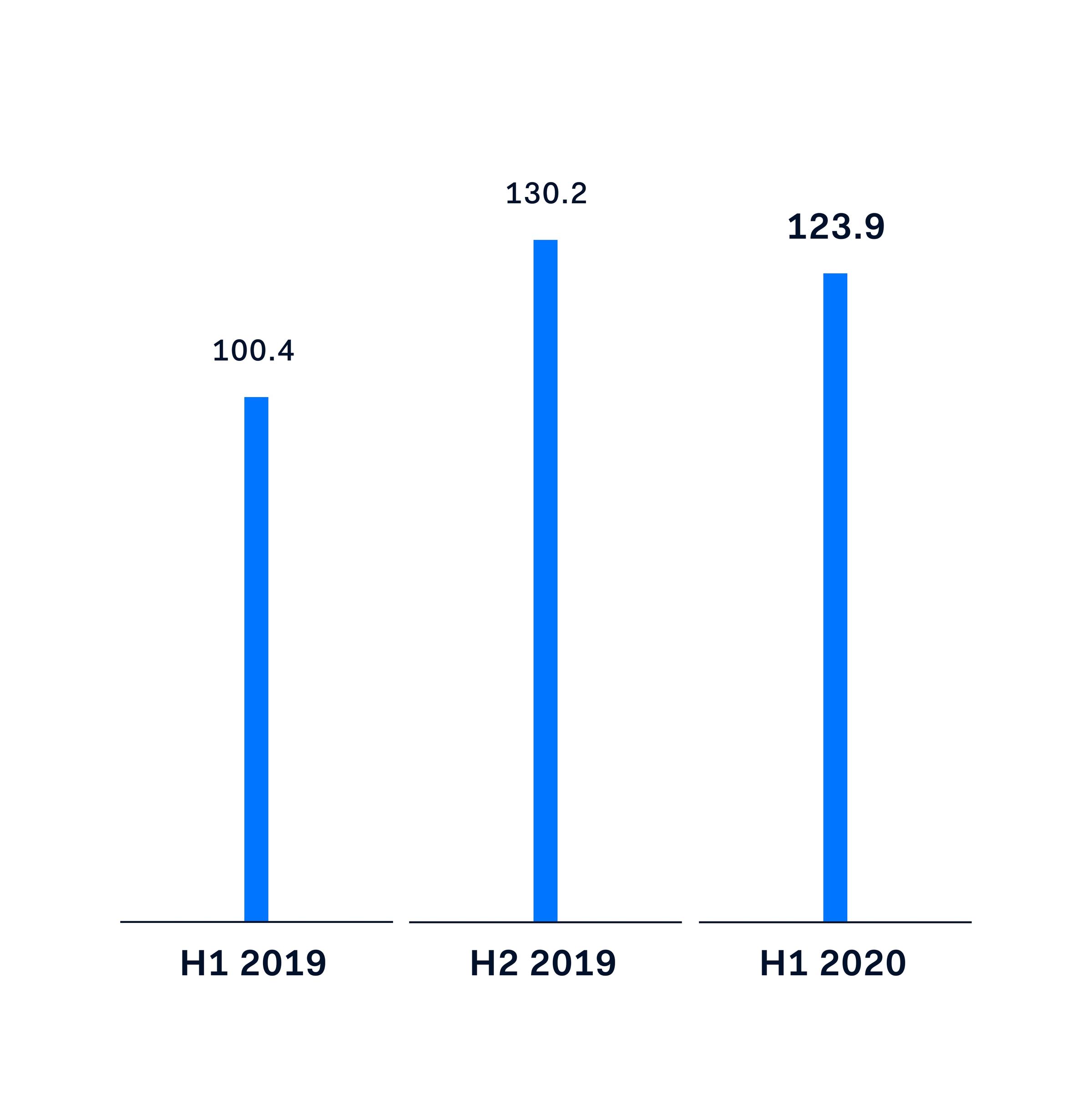

Enterprise volume in EUR billions

Unified commerce

The day-to-day of many merchants changed severely due to the pandemic. We focused on helping them, by moving volumes online swiftly. In reopening scenarios, we are ready to help merchants open up safely – all our POS devices facilitate contactless.

Mid Market

We continue to invest in our long-term approach of moving into the next-adjacent segment to enterprise. We provide these merchants with access to the full strength of the Adyen platform via simplified integrations, so they can focus on growing their business.

Interim Condensed Consolidated Financial Statements H1 2020 Adyen N.V.

Unsponsored ADRs: As of October 10, 2008, the US Securities and Exchange Commission (SEC) published revisions to Exchange Act Rule 12g3-2(b) which permits depository institutions to establish unsponsored ADR programs without the participation of a non-US issuer. Adyen NV does not consent to the establishment of any unsponsored ADR program, and further does not authorize, endorse, support or encourage the creation of any such unsponsored ADR program in respect of its securities. Adyen NV will not actively, directly or indirectly participate in the creation of any unsponsored ADR program. Adyen NV specifically disclaims any liability whatsoever arising out of or in connection with any unsponsored ADR program. Adyen NV does not represent to any depository institution or any other person, nor should any depository institution or any person rely on a belief that the website of Adyen NV includes all published information in English or that Adyen NV otherwise satisfies the exemption criteria set forth in Exchange Act Rule 12g3-2(b).